Section

Breadcrumbs

Rental Housing Tax Credits (RHTC)

This page is intended primarily for developers of affordable rental housing in the state of Indiana. The Rental Housing Tax Credit program (RHTC) is a federal source of funds and one of the country's and our state's most powerful tools for creating new affordable rental housing.

The Qualified Allocation Plan (QAP) provides selection criteria and application requirements for the Rental Housing Tax Credit (RHTC) and multifamily tax-exempt bond programs.

Click HERE to access the IHCDA Payment Portal

RED Compliance

RHTC Manual and other resources

IHCDA Online Compliance Reporting

- Housing Credits Schedule

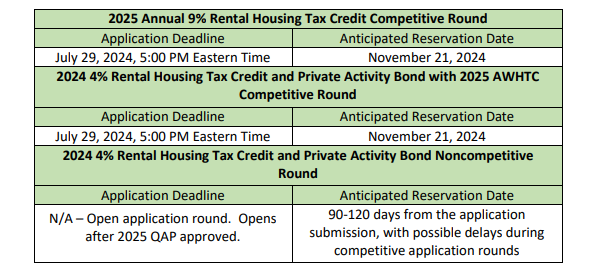

2025 QAP Funding Rounds

2025 General Set-Aside

2024 9% and 2023 4% / State Credits

- Click here to access the 2024 General Set-Aside Applicant List

- Click here to access the Form C List for the 2024 General Set-Aside

- Click here to access the 2024 General Set-Aside Frequently Asked Questions

- Click here to access the 2024A-C Applicant List - Updated August 11, 2023

- Click here to access the 2023 Bond & State Tax Credits Applicant List - Updated July 17, 2023

- Click here to access the Form C List for the 2023 Bond/State Tax Credit Round - Updated June 30, 2023

- Click here to access the Form C List for the 2024 9% Round - Updated July 26, 2023

- Click here to access the Bond Round applications and awards

- QAPs - Past and Present

2025 Qualified Allocation Plan (QAP)

Final Version

- 2025 QAP - Final

- 2025 QAP - Final - Redlined Version

- 2025 QAP Frequently Asked Questions and Clarifications - Updated July 2, 2024

- 2025 QAP Summary of Changes

- RED Notice 24-17 - 2025 Qualified Allocation Plan (QAP)

- 2025 QAP Appendices

- 2025 QAP Schedules

- 2025 QAP Forms

2nd Draft

- 2025 QAP - 2nd Draft

- Summary of Changes - 2nd Draft

- 2025 Schedule C - Market Study Requirements

- Schedule D1 - Competitive Private Activity Tax-Exempt Financing with AWHTC - DRAFT

- Schedule E - Procedures for Accessing HOME Funds

- Schedule J - Procedure for Accessing Development Fund Loan - DRAFT

1st Draft

- 2025 QAP - 1st Draft

- Policy Brief One-Pager

- Summary of Changes - 1st Draft

- 2025 Schedule D - Noncompetitive Private Activity Tax-Exempt Bond Financing - 1st Draft

- 2025 Schedule D1 - Competitive Private Activity Tax-Exempt Bond Financing with AWHTC - 1st Draft

- 2025 Schedule D2 - 501(c)3 Bonds - 1st Draft

2023-2024 Qualified Allocation Plan (QAP)

2023 Multifamily Tax-Exempt Bond Volume and Affordable and Workforce Housing Tax Credit

- Bond-State Tax Credits FAQs - Updated June 28, 2023

- RED Notice 23-10: Amended Schedules D1 & D2 of 2023-2024 QAP

2023 9% Round

- 9% Funding Round FAQs - Updated June 28, 2023

2023A-C Round Postponement

- 2023A-C Round Postponement FAQs - Updated December 12, 2022

- List of Approved Market Study Providers - Updated September 7, 2023

- Note: See RED Notice 22-58 for information regarding the round postponement

Final Version

- 2023-2024 QAP

- 2023-2024 QAP - Summary of Changes

- 2023-2024 QAP Forms

- 2023-2024 QAP - Form A - 9% Tax Credits - Updated January 4, 2024

- 2023-2024 QAP - Form A - 4% Credits Tax Exempt Bonds - Updated May 8, 2023

- 2023-2024 QAP - Form A - 501(c)3 Tax Exempt Bonds - Updated April 20, 2023

- 2023-2024 Form D - 2023 Carryover Agreement

- 2023-2024 QAP Schedules

- 2023-2024 QAP Appendices

- Opportunity Index and Housing Need Index - Updated May 5, 2023

- Maps for Opportunity Index and Housing Needs Index

- Schedule L - Procedure for the Creation of the Housing Need Index - Updated May 9, 2023

- List of Approved Market Study Providers - Updated December 19, 2022

2nd Draft

- 2023-2024 QAP 2nd Draft

- 2023-2024 QAP 2nd Draft - Summary of Changes

- Schedule C - Market Study Requirements

- Schedule D-1 - Private Activity Tax-Exempt Bond Financing

1st Draft

- 2023-2024 QAP 1st Draft

- 2023-2024 QAP 1st Draft - Summary of Changes

- Schedule B - Transferability of Rental Housing Tax Credits

- Schedule C - Market Study Requirements

- Schedule D-1 - Private Activity Tax-Exempt Bond Financing

- Schedule E - Procedures for Accessing HOME Funds

- Schedule J - Procedures for Accessing Development Fund Loan

2022 Qualified Allocation Plan (QAP)

- 2022 QAP - Final

- 2022 QAP Forms

- Form D - 2022 Carryover Agreement

- Form E - Tax Credit Lien - Revisions for 2022 Allocations

- 2022 QAP Schedules

- Schedule C - Preferred Market Study Provider Application

- 2022 QAP Appendices

2020-2021 Qualified Allocation Plan (QAP)

- 2020-2021 QAP - FINAL

- QAP Form A - Updated August 5, 2020

- Explanation of QAP Form A update

- 2020-2021 QAP Forms - Updated May 10, 2023

- 2020-2021 QAP Schedules - Updated June 3, 2019

- 2020-2021 QAP Appendices - Updated June 3, 2019

- 2020-2021 QAP Frequently Asked Questions - Updated May 8, 2020

- 4% Credits / Tax-Exempt Bonds Application Frequently Asked Questions

- 2020-2021 QAP Overview at IAHC Annual Meeting

- 2020-2021 QAP - FINAL - Summary of changes

2018-2019 Qualified Allocation Plan (QAP)

- 2018-2019 QAP

- 2018-2019 QAP Forms - Updated March 26, 2019

- 2018-2019 QAP Schedules - Updated May 22, 2018

- 2018-2019 QAP Appendices - Updated October 19, 2017

- 2018-2019 QAP Frequently Asked Questions - Updated May 17, 2018

- 2018 National Housing Trust Fund Application Policy

- 2018 National Housing Trust Fund Threshold Requirements

- 2018 National Housing Trust Fund Supplemental Application

- RED Notices / Newsroom

Click here to access all of IHCDA's RED Notices

- Final Application and Inspection – Form 8609

QAP Final Application Template (applicable to all QAP years) - Updated January 9, 2024

Contacts

- Jack Powell - Real Estate Investment Underwriter

- General Reference Materials

- 2024 Affordable and Workforce Housing Tax Credit Awards

- Most Common Construction Issues Presentation - 2019 Indiana Housing Conference

- 2023 RHTC Cost Containment Data

- Utility Allowances

- FAQ - What is Section 42 Rental Housing

- Tenants Guide to Section 42 Rental Housing2023-2024 QAP Frequently Asked Questions

- CORES Presentation Slides

- CORES Presentation Recording

- Use code v^t!$G#0 to access the training video

- Current Applications, Recent Awards, and Existing Properties

- Click here to access copies of the Form A submissions for the 2025 Rental Housing Tax Credit Round

- Click here to access information regarding 9% and 4% Bond Developments

- Click here to access information regarding TCAP Developments

- Click here to access a listing of Existing Rental Housing Tax Credit Properties

- Qualified Contracts

- Qualified Contracts Under Review Listing - Updated November 21, 2024

- Projects Released Through Qualified Contracts